Securing sufficient/adequate/reliable car insurance is a critical/essential/vital part of being a responsible driver. However, navigating the complexities/insurance options/various plans can be challenging/daunting/overwhelming, especially when facing financial constraints/budget limitations/cost concerns. Fortunately, there are strategies/options/solutions to bridge this finance gap and ensure you have the coverage/protection/safety net your vehicle requires. website

- First/Firstly/To begin with, assess your individual needs/specific requirements/unique situation.

- Secondly/Next, consider/Furthermore, explore various insurance providers/different companies/multiple options to compare rates/find competitive prices/get quotes.

- Finally/Lastly/In addition, utilize discounts/explore available savings/look for reductions based on your driving history/vehicle type/age/other factors.

By carefully planning/strategically selecting/making informed choices, you can obtain the necessary car insurance coverage/secure affordable protection/get the right policy that fits both your financial situation/budgetary needs/spending limitations and your driving requirements/safety priorities/peace of mind.

Safeguard Yourself Against a Negative Equity Nightmare with Gap Insurance

Purchasing a new car is an exciting experience, but it's important to evaluate the potential risks involved. One such risk is negative equity, which occurs when you owe more on your loan than your automobile is worth. This can happen if the value of your automobile depreciates faster than you reduce your loan balance. Gap insurance extends protection against this scenario by covering the difference between what you owe on your loan and the actual cash value of your vehicle.

Without gap insurance, you could be left with a significant financial burden if your vehicle is totaled in an accident or theft. Nevertheless, gap insurance can give you peace of mind knowing that you won't be stuck for paying off the remaining balance on your loan.

- Think About gap insurance when you purchase a new vehicle.

- Talk with your financial agent to see if gap insurance is right for you.

- Compare quotes different insurers to find the best coverage and rates.

Auto Gap Insurance Explained: Benefits and Coverage

Buying a new car is exciting, but unexpected events can happen anytime. This is why it's essential to have car gap insurance. Gap insurance steps in when your car is totaled or stolen and the actual cash value (ACV) doesn't cover the remaining loan balance on your auto loan.

Here's why gap insurance offers significant safety net:

- Safeguards you from paying the difference between what your lender owes and what your car is worth.

- Gives peace of mind knowing you're protected against financial burden.

- Is often relatively inexpensive compared to the potential costs of being unprotected.

Don't wait for an accident to happen. Investigate adding gap insurance to your auto policy and ensure yourself against unforeseen financial challenges. Your future self will be grateful.

Say Goodbye to Financial Stress: Explore Gap Policy Insurance

Financial stress can impact your life in a variety of ways. Unexpected expenses can quickly erode your savings and leave you feeling worried. However, there's a way to minimize this risk and gain peace of mind: Gap Policy Insurance.

Gap protection provides an extra layer of security by covering the financial void that traditional insurance programs may fail to address. This means you'll have monetary support when necessary, helping you to cope with unforeseen events without affecting your standard of living.

Exploring Gap Policy Insurance can be a smart decision for anyone who appreciates financial security.

Avoid Costly Unexpected Expenses: Understand Gap Cover Insurance

Unexpected bills can severely impact your budgetary stability. Gap cover insurance serves as a safety net, filling the voids left by your main health coverage. This type of insurance steps in when typical coverage is insufficient, ensuring you receive the essential healthcare treatment you need. By understanding gap cover insurance, you can safeguard yourself from exorbitant unexpected bills, ensuring peace of mind during difficult times.

- Evaluate your existing health policy

- Research different gap cover insurance options

- Analyze coverage levels and premiums

Simplify Your Auto Financing: Get Comprehensive Gap Insurance Coverage

Purchasing a vehicle is a major financial decision. To ensure you have complete peace of mind throughout the financing process, consider adding comprehensive gap insurance coverage. This valuable protection helps cover the gap between what you owe on your auto loan and the actual cash value of your car in case of an accident or damage. Gap insurance provides invaluable financial security, especially during the early years of ownership when your vehicle depreciates most rapidly.

- Reduce your financial stress in unforeseen circumstances.

- Secure your investment against depreciation.

- Gain assurance knowing you're fully covered.

Don't neglect on the benefits of gap insurance. It's a wise investment that can substantially simplify your auto financing experience and provide long-lasting financial reassurance.

Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Pauley Perrette Then & Now!

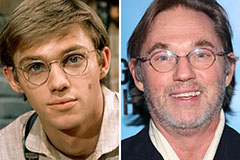

Pauley Perrette Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!